The Quick & Dirty Formula for Calculating your App Startup's Valuation

Most startups will try to place a valuation on their company when they are looking for investors. Valuations are crucial for investors and founders because they need to make sure all parties involved are getting a fair deal. This can be particularly difficult for app startups, because of the lack of physical assets and intellectual property that is inherent.

However, the simplest way app startup founders can get a realistic idea of their business's worth is by putting a number value on the user base they have acquired. Disclaimer, you'll only want to use this method if your end users are paying customers.

How to calculate your app valuation

Valuation = Number of app users * (User LTV - CAC)

- 314,159 App users * ( $126.04 LTV - $5.99 CAC) = $38M Valuation

This formula will give you the total value of your app’s user base. The average lifetime value (LTV) of a user is the average amount of money they will spend using your product or services. When you subtract the cost to acquire one customer (CAC) through marketing or sales from LTV, you get the net profit for each user your app has. All you have to do is multiply this number by the number of users you have to get a realistic idea of the total value of your app’s user base.

User LTV = (Average sale price, ASP) * (Repeat customer rate, RCR) * (Average customer retention time in months or years)

- $14.99 ASP * 2.94 RCR * 2.86 Year retention = $126.04 User LTV

CAC = (Total marketing spend related to acquisition for a set period) / (Number of users acquired during that period)

- $1.59M Marketing spend / 265358 Users acquired = $5.99 CAC

For example, say you have 314,159 users on your new personal finance app, and you figured out that through in-app purchases, the LTV of each user is approximately $126.04 and your CAC is $5.99—this would give your company a valuation of about $38M.

Other factors to consider

Keep in mind this is a very basic formula, and will not give you a 100% accurate valuation of your startup. Many other factors may raise or decrease your valuation, but target market, user base growth, engagement, and churn rate are the most important.

Growth rate

It’s important to analyze your user base growth in context. Growth is not a constant goal for startups, so you have to be strategic when deciding between investing money in growth and investing money in developing the product. According to Y Combinator founder, Paul Graham, there are three phases during the growth of a successful startup:

1. "There's an initial period of slow or no growth while the startup tries to figure out what it's doing." Growth shouldn’t be a significant factor in valuation when you’re in this stage.

2. "As the startup figures out how to make something lots of people want and how to reach those people, there's a period of rapid growth." If you can’t grow quickly during this stage, there may be a problem. Growth should be a big factor in your company’s valuation.

3. "Eventually a successful startup will grow into a big company. Growth will slow, partly due to internal limits and partly because the company is starting to bump up against the limits of the markets it serves" When you’re this large, you shouldn’t devalue your company because growth is slowing. That’s a natural effect of the market.

Young startups should be focused more on engagement, as new companies are still trying to figure out what their customers actually want. Only after the foundation is built does the growth rate become important.

User engagement

How much engagement is your app driving? Snapchat’s $20 billion valuation was predicated on how important the app was to the daily lives of its users. Their “addicted” Millennial users were hyper-engaged. Around 2017 Snapchat had about 68 million daily active users and was getting over a billion launches every single day. Almost a decade later, TikTok is in a similar boat, but with a new generation of users. Young Zoomers are leading the charge, spending almost 2 hours a day on the app. Gen Z is estimated to account for more than 36% of all users, with 730 million monthly users—that’s more than 26 million actively engaged users.

While you’re still in the first startup stage, consider your engagement level a big factor in valuation. Most startups don’t obtain massive sales volume from the start, so they have to estimate what they think sales volume will be in the future. The best way to forecast future sales is current engagement. If people are spending a lot of time in your app and are coming back - it's a good sign they like your app. Even if they aren’t paying right now, there’s a high chance they will in the future.

Think about your experiences when paying for apps. If you download a free app and enjoy it, you’ll consider paying for in-app purchases. You wouldn’t make those purchases right when you download it because you’re not aware of the value it provides yet. Everybody thinks this way. Don’t expect massive sales before you have even shown value. When it comes to mobile startups the demographics of your user base also play into engagement一specifically age. Studies have shown that people of different ages have various needs that affect their usage and evaluation of apps.

Gen Z, sometimes called digital natives, are estimated to account for close to 40% of all mobile usage. If young adult users are your primary audience it's easier to get a higher valuation due to the direct link between engagement and potential profits. As apps continue to evolve we expect to see a continued emphasis on diversified revenue streams, ranging from in-app purchases to subscriptions that offer pro-level features, which could increase valuation amounts.

Churn rate

How long are people using your app until they stop using it? Investors will be keeping a close look at your churn rate, because if people are dropping off after a few days or weeks, your app does not have a product-market fit, and therefore would not be worth investing in.

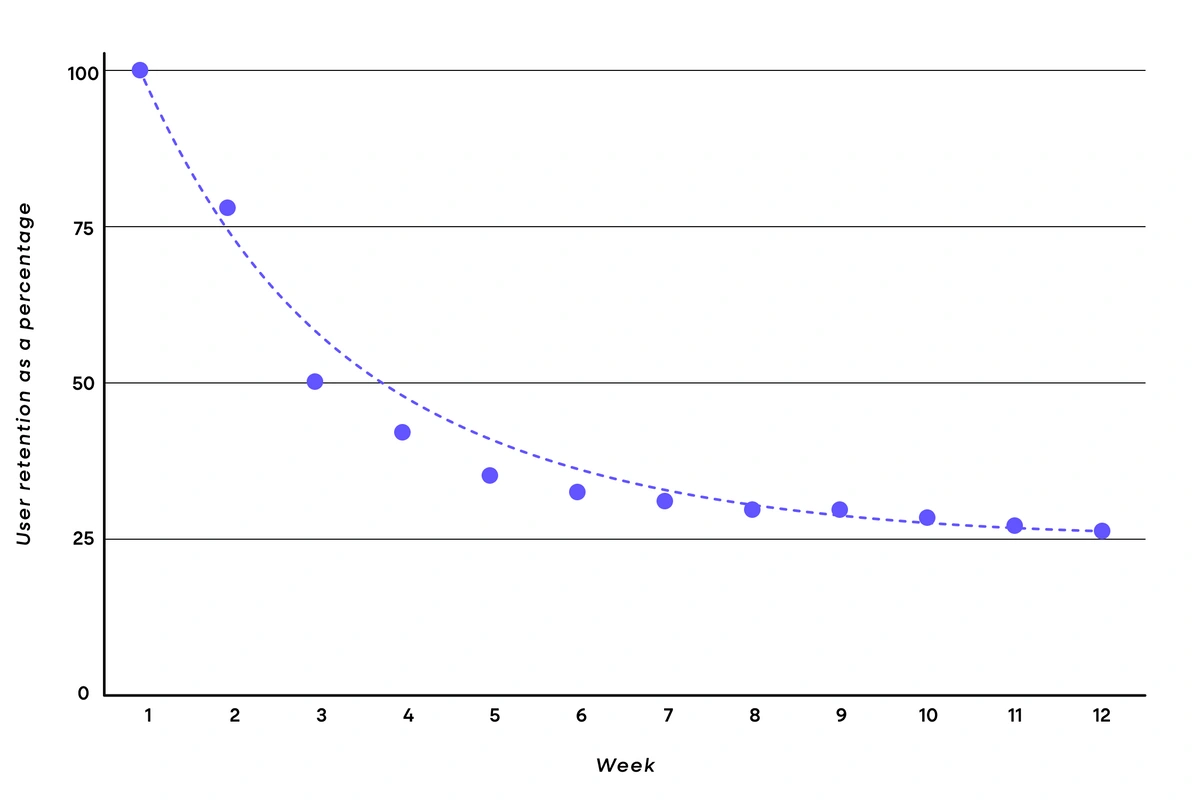

There is no “ideal churn rate” because once again, every app and industry is different, but you should always aim to reduce churn as much as possible. It’s cheaper to retain an existing customer than acquire a new one. On the other hand, if your retention rate exceeds industry baselines, you can expect a higher valuation. According to Upland, average retention rates hover just above 25% and drop to close to 5% over 30 days.

How to calculate churn rate

Churn Rate = (1 - Retention rate)

You can find your retention rate in Google Analytics or iTunes Connect by going to the cohort analysis or retention section. It should look similar to the graph below, but may also be visualized as a cohort retention chart. In our example: after 12 weeks the average retention rate seems to be slightly over 25%, meaning after 12 weeks, there is a churn rate of around (1 - 0.25) or 75%.

Other startup valuation formulas

- Dave Berkus

- Venture Capital

- First Chicago

- Discounted Cash Flow

- Liquidation

- Risk Factor Summation

- Scorecard

- Book Value

- Comparable Transactions

- Cost-to-Duplicate

This article was updated on January 26th, 2023 to provide up-to-date information, reflect current market trends, and outline revised best practices. Additional contributions and editing by JD Post.

Read more academy articles →